When I was 16, my mother helped me get an after-school job loading trucks at a factory in Philadelphia. I learned a lot about how the world works during the two years I worked there.

As a part-time dock loader, I was low man on the totem pole. I’m certain I was also the lowest paid. But it was enough to take my girlfriend on dates and have a little extra money of my own.

The owner of the factory was a relatively young man of roughly 40. He was rarely around the plant—I think I saw him only five or six times in two years. He was always well dressed, with a very fancy car and sometimes a pretty woman.

He paid me to load trucks presumably because he made enough money to pay me, pay for the plant, pay for my supervisor, and pay for the car and his date and still have more leftover. And the best part for him was that he didn’t have to do the work. I did . . . well, and all the other people who worked there.

Willard was the owner’s name. And as the song says, “Nice work if you can get it.”

But you know what the next line of that song is? “And you can get it if you try.”

You can. And in many ways you can get a better deal than Willard had. Because Willard had a lot of risk. If the company failed, no more nice cars and pretty ladies. But you can get the same kind of deal Willard had, with less risk—and you don’t even have to show up for it.

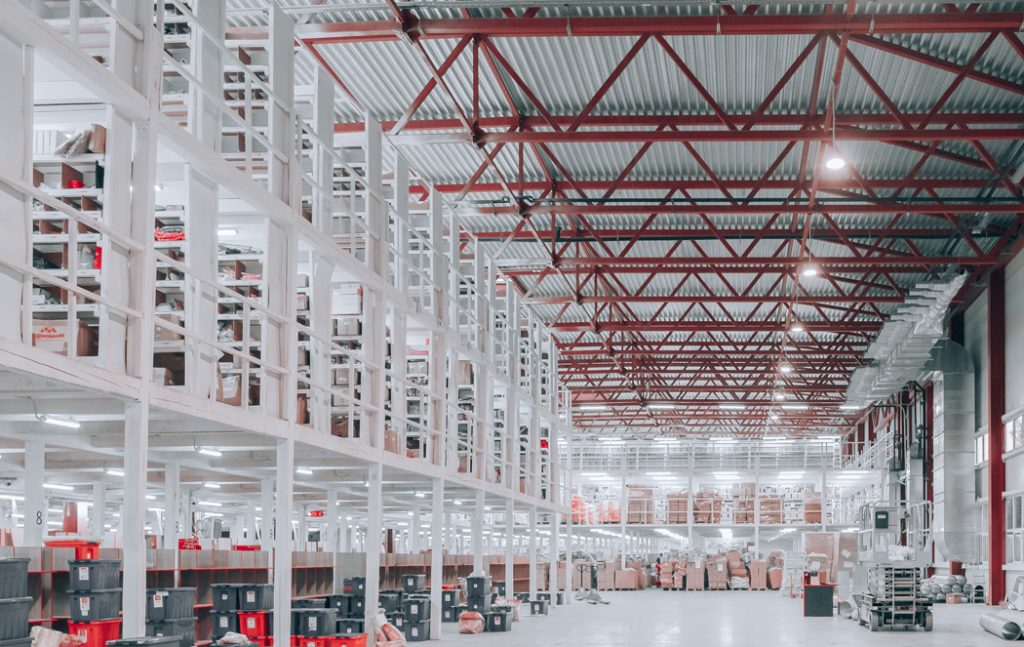

I am a part owner of thousands of properties leased to some of the largest corporations in the world. I am also a part owner of some of those very corporations that pay rent on my properties. Other people run these companies and properties. They supervise workers of all kinds. Somewhere in there are more than a few dock loaders like I once was, but they now work for me, and I make enough from their work to pay them, pay for the properties, and have something leftover.

Sounds like I’m some powerful titan of industry, right? Nah. I’m a shareholder.

Doesn’t sound like such a big deal when I put it that way, right? But a shareholder is all of the things I listed above with some very big differences from Money Willard’s deal. I don’t have to do anything at all. I don’t have to make any decisions about how the place is run, and if the people who run it mess up, I can just sell my interest and move along. My biggest decision is choosing what companies I want to be a part owner of.

I mean, isn’t this the best gig that anyone ever invented? I buy a tiny piece of a great company (really, a lot of great companies) and I just sit back and the money rolls in.

And yet, I talk to people all the time who want to monkey with it. They’ve got the best deal that anyone has ever imagined, but they want to improve on it. They want to try to time the best moment to own stocks and be out when prices are falling. Sounds good, until you really think about it. The businesses I own are great businesses. They are almost always able to run their operations and make money at it, no matter what their stock price is. The price goes up and down based on the perceptions of people who are not running the company! Why would I ever let the perceptions of outsiders effect my ownership?

Look, if I own a corner gas station and people come in and out all day buying gas and soda pop and candy and whatever, other people might come up with all kinds of reasons to worry about how my business is going. But those reasons are imaginary. They might be founded in reasonable ideas, but they are still imaginary. The cash register is real.

Yesterday, I was reviewing some of my holdings and I found three companies that have paid dividends every quarter for over 100 years. Now, in those 100-plus years, I am absolutely certain that there have been a lot of people who have expressed worries about those companies. Well, let me keep this very simple. If you have worries like that, please don’t tell me. I’m busy taking dividend checks to the bank.

Hal Masover is a Chartered Retirement Planning Counselor and a registered representative. His firm, Investment Insights, Inc is at 508 N 2nd Street, Suite 203, Fairfield, IA 52556. Securities offered through, Cambridge Investment Research, Inc, a Broker/Dealer, Member FINRA/SIPC. Investment Advisor Representative, Cambridge Investment Research Advisors, Inc., a Registered Investment Advisor. Investment Insights, Inc & Cambridge are not affiliated. Comments and questions can be sent to hal.masover@emailsri.com These are the opinions of Hal Masover and not necessarily those of Cambridge, are for informational purposes only, and should not be construed or acted upon as individualized investment advice. Investing involves risk. Depending on the types of investments, there may be varying degrees of risk. Investors should be prepared to bear loss, including total loss of principal. Past performance is no guarantee of future results.

Indices mentioned are unmanaged and cannot be invested in directly.